During the Coronavirus pandemic, there was an increase in fraudulent payment scams. Unscrupulous individuals regrettably took the opportunity to exploit the situation where everyone was working from home potentially with decreased cyber security, to carry out fraudulent acts.

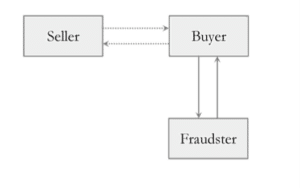

One of the fraudulent payment scams that appears to be on the rise includes diverting legitimate business payments. For example, in a sale contract, the buyer is required to pay the contract price to the seller. However, a dispute arises between the buyer and the seller, when the perpetrator of the fraud causes the buyer to pay the fraudster instead of the seller (as indicated on the below diagram).

From the above, it is clear that there is a direct line of communication between the buyer and seller. However, there is also a direct line of communication between the fraudster and buyer, and then the seller and buyer, which is outlined below:

- The fraudster intercepts communications between the buyer and seller, often impersonating the seller, to enter into a dialogue with the buyer.

- The buyer then responds to the fraudster, excluding the seller from future discussions. This can sometimes be done by creating an email domain similar to that of the seller with perhaps one letter changes so as not to immediately arouse suspicion (maybe substituting ‘Steven’ in an email address with ‘Stephen’.

- The fraudster may then eventually then provide its own bank details to the buyer for the purposes of completion, and the buyer then pays the fraudster (thinking that they are the seller).

- This usually comes to light when the bona fide seller asks the buyer for payment.

Dreamvar (UK) Ltd v Mischon de Reya and others

The case of Dreamvar (UK) Ltd v Mischon de Reya and others is an example of a similar fraudulent property transaction, which appears to be increasingly on the rise.

The sequence of events of this transaction appears below:

- Dreamvar was a small property company that entered into an agreement to purchase a house in London.

- However, the purported seller of the house was actually a fraudster, who had obtained the driving licence of the true owner. In light of the strict obligations on solicitors and law firms to check the identity of their client (with extensive checks being required in conveyancing), the fraudster had provided copies of ID, which had been certified by a solicitor as being true copies of originals.

- These ID documents were then passed to a different law firm, Mary Monson Solicitors, to act on the fraudster’s behalf.

- Mischon de Reya were instructed to act on behalf of Dreamvar, the purchaser.

- The transaction progressed quickly and upon completion, Mischon de Reya transferred the completion funds of £1.1 million to Mary Monson Solicitors.

The fraud was later discovered by the Land Registry prior to registering the purchase, however by this time, Mary Monson Solicitors had transferred funds to the fraudster and the sale proceeds had disappeared.

There are several key issues that were raised from the Dreamvar case discussed above, however, it has raised the important issue of freezing injunctions being taken against ‘persons unknown’. Although in such circumstances, the buyer would remain liable for the making payment of the £1.1 million to the true owner unless discharged under the contract or though agency, it is also important to consider the relevance of a freezing injunction.

In the Dreamvar case, the fraudster was the purported seller, who passed themselves off as being the true owner of the property and presented certified copies of ID in order to do this. It was therefore unclear who the true fraudster was and their identity. It can be difficult for the purchaser to decide which party to take action against; the fraudster or any third parties the parties involved in this fraudulently-diverted payment often play “the blame game” as to who is liable.

However, an important option is to consider a freezing injunction promptly against the fraudster, i.e. persons unknown. An important case is World Proteins Kft v Persons Unknown [2019] 4 WLUK 35, whereby the Court granted a freezing injunction against ‘persons unknown’, a cyberfraudster.

How BTMK can help

In such fraudulent payment scams, it is crucial that you consider freezing injunction action as soon as the fraud is discovered to prevent the completion monies disappearing. The sad reality is that it may already be too late and as such there may be a resulting claim against a professional involved in the transaction with suitable insurance, or against a financial institution who often will take matters where their own customer has been defrauded very seriously.

BTMK has a specialist Civil Litigation and Dispute Resolution Department, with decades of experience in this extensive area. Further detail on BTMK’s experience in this area is stated in our guide to injunctions: https://www.btmksolicitors.co.uk/personal-law/litigation-and-dispute-resolution/injunctions/

If you have suffered as a result of a fraudulent property transaction and are seeking advice on your next steps, please do not hesitate to contact our Dispute Resolution Department for expert guidance and sound legal advice. BTMK has 24/7 phone lines and online chat facilities and our team are able to assist with all urgent matters, with a varied team of Directors, Solicitors, Paralegals, Trainee Solicitors and Apprentice Solicitors.

Article written by Emily Aylott (Apprentice Solicitor) in the Civil Litigation and Dispute Resolution Department. Emily can be contacted on 01702 238504 or [email protected] in the first instance to discuss your available options.